Black Tuesday 1929: The Day that Shook America’s Economy

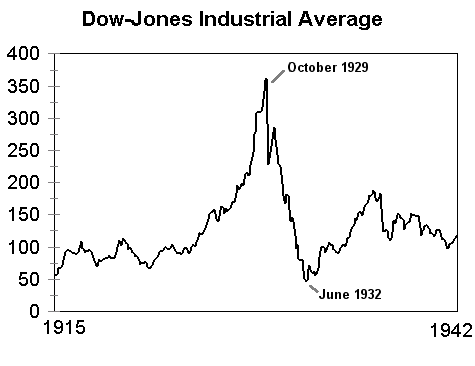

On October 29, 1929, a day that would become infamously known as Black Tuesday, the U.S. stock market crashed, triggering the onset of the Great Depression. This catastrophic day saw unprecedented selling on Wall Street as panic overtook the market. Investors lost billions of dollars, and the American economy faced a massive downturn that would last for an entire decade.

What Led to the Black Tuesday Stock Market Crash?

In the years leading up to 1929, the U.S. economy experienced rapid growth, known as the “Roaring Twenties.” Many people invested heavily in the stock market, with companies’ values soaring to unsustainable heights. Speculation and overconfidence grew, leading to extensive buying on credit, also known as “margin buying.” However, cracks in the economy began to show as consumer spending slowed, and stock prices fell sharply, ultimately leading to a wave of panic selling on Black Tuesday.

The Impact of Black Tuesday on American Lives

Black Tuesday was more than just a financial crisis; it marked the beginning of economic devastation across the United States. With the stock market crash, banks closed, savings were wiped out, and many lost their life’s earnings. Unemployment soared, with millions out of work, and families struggled to make ends meet. People who once enjoyed economic prosperity were now facing the harsh reality of poverty.

“The 1929 stock market crash was the beginning of the economic collapse that would devastate an entire generation.”

How Black Tuesday Led to the Great Depression

The Great Depression, which followed Black Tuesday, is often considered the worst economic crisis in American history. This era saw widespread unemployment, severe poverty, and a collapse in both industry and agriculture. The impact was so deep that it took nearly ten years for the economy to recover fully. This long-lasting depression shaped policies, changed the way Americans viewed economics, and led to increased federal involvement in the economy.

Key Changes After Black Tuesday

In response to the crash, the U.S. government eventually enacted policies aimed at stabilizing the economy. President Franklin D. Roosevelt’s New Deal was a direct response to the Great Depression and included reforms like the Social Security Act and the Glass-Steagall Act, which introduced regulations to prevent future market collapses. These changes aimed to restore public confidence in the financial system and prevent a repeat of Black Tuesday.

Lessons from Black Tuesday

- Speculation and Risk: Black Tuesday showed the dangers of excessive speculation and over-reliance on borrowed funds in the stock market.

- Economic Regulation: It underscored the need for proper regulation to protect investors and the economy from unchecked market risks.

- Federal Support: The event highlighted the government’s role in stabilizing and supporting the economy during crises.

Conclusion: Remembering Black Tuesday’s Legacy

Black Tuesday stands as a stark reminder of the dangers of financial speculation and the critical importance of economic stability. The crash not only shattered the American Dream for millions but also reshaped economic policies, leaving a legacy that influences financial regulations today. The lessons learned from the stock market crash of 1929 continue to remind us of the risks inherent in economic booms and the importance of maintaining balance in the market.